OR

Sebon paves way for stock brokers to provide margin lending services

Published On: February 2, 2019 11:28 AM NPT By: Republica | @RepublicaNepal

KATHMANDU, Feb 2: The Securities Board of Nepal (Sebon) has allowed stock brokerage firms to provide margin lending to investors.

Issuing a circular on Friday to Nepal Stock Exchange (Nepse) and brokerage firms, the securities market regulator paved the way for brokerage firms to provide financing service for their clients to purchase stocks in the secondary market.

The circular came after a delay of over a year, which was mainly due to lack of working procedure for implementation of the service. The Sebon had first mooted the idea to introduce margin lending service from brokerage firms in November 2017.

According to the Sebon circular, brokerage firms will be free to set their interest rates on the margin loan. Such interest rate should be mentioned in the contract between the brokerage firm and the client. However, brokerage firms should pre-inform Nepse and Sebon about the interest rates.

Though the Nepse had drafted the working procedure on margin transaction service in May last year in line with a Sebon directive of November 2017, such facility for investors could not come into implementation amid disagreement between the Sebon and the Nepal Rastra Bank over issues of jurisdiction.

Earlier, the NRB had reportedly said that the brokerage firms who wanted to provide margin lending service should acquire the permit of the central bank, which is the apex regulator of financial intermediaries.

However, it has not been clear whether such disagreement between the central bank and securities market regulator has been sorted out.

But, the Sebon has decided to bring the margin lending service from brokerage firms into operation and informed the new arrangement including the working procedure and its earlier directive to the NRB.

“The margin lending facility for brokerage firms comes under the regulatory ambit of the Sebon. We are implementing it following the decision of the board that includes a member representing the Ministry of Finance,” Rewat Bahadur Karki, the Sebon's Executive Chairman, told Republica.

After the margin lending facility starts being available from brokerage firms, investors will be no longer required to rely on bank and financial institutions (BFIs) for loans to buy stocks in the secondary market.

The new facility is expected to make it easier for investors to trade shares and expand the scope of business for brokerage firms. So far, stock brokerage firms are allowed only to execute trading orders placed by their clients in the secondary market.

Meanwhile, the Sebon has also said that it will make intervention in the market if it finds any 'unusual situation' in interest rates after the margin lending service comes into operation.

Nepse officials say that they will start the process of allowing brokerage firms to provide margin lending service after they formally receive the directive from the Sebon.

“We will make calls from brokerage firms and issue eligible stock brokers the permit to provide margin lending service in line with the working procedure that we have prepared and approved by the Sebon,” said Murahari Parajuli, Nepse's spokesperson.

You May Like This

Stock market to remain closed for five days

KATHMANDU, March 23: The Securities Board of Nepal (Sebon) has instructed Nepal Stock Exchange (Nepse) to shut stocks transaction from... Read More...

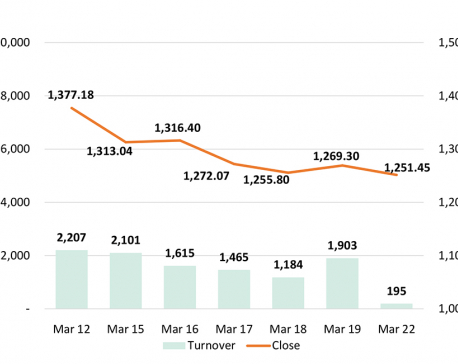

Nepse ends 18 points lower

KATHMANDU: The local bourse witnessed one of its most bland trading sessions as associations of merchant banks and stock brokers... Read More...

Finance Committee directs govt to take action against Sebon and Nepse officials

KATHMANDU, August 20: The Finance Committee under the House of Representatives has directed the government to carry out an investigation... Read More...

_20240516174954.JPG)

Just In

- Nepali citizens traveling abroad on various visas can obtain 'Legitimization Work Permit’ from Nepali embassy

- 2024 ICC Men’s T20 World Cup: Nepal to face the Netherlands in their first match

- World Peace Flame sent to Everest Base Camp

- NEPSE inches up 0.79 points, daily turnover rises to Rs 4.23 billion

- Slovakia PM Robert Fico in stable but serious condition after shooting, doctors say

- Dr Govinda KC breaks hunger strike

- HoR meeting postponed

- NC obstructs HoR meeting (live)

Leave A Comment