OR

#Nepal Investment Summit 2024

‘We have established a long-term vision and policy stability in key investment sectors’

Published On: April 28, 2024 11:30 AM NPT By: Republica | @RepublicaNepal

This summit is not owned by a particular political party but is an event of Nepal as a state. We have provided space for experts from various sectors, including different political parties. Former finance ministers, regardless of their political affiliations, have been honored with key roles as panelists.

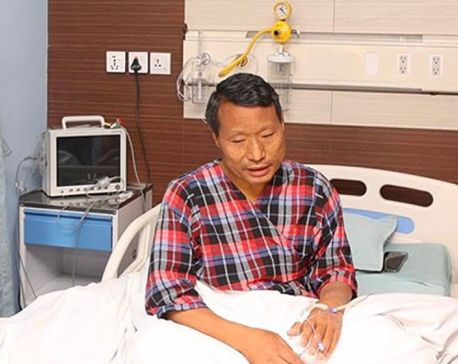

Finance Minister Barshaman Pun is the coordinator of the Nepal Investment Summit 2024 Steering Committee. In his capacity as the coordinator, Minister Pun has been playing an instrumental role in making this mega event a success. In this context, Republica caught up with Minister Pun to delve into the government's preparations and other pertinent matters related to the Investment Summit. Here are the highlights:

What are the primary objectives of the Investment Summit 2024, and what does the government hope to achieve this time?

This is the third edition of the investment summit. This is the time to materialize the lessons learned from previous experiences. We have also studied the outcomes of similar events in other countries, which show that they achieve actual Foreign Direct Investment (FDI) around 30 percent of the pledged amount. In our case, the realization rate is 35-40 percent. Still, we are closely observing why it has not surpassed this level. Drawing from past experiences, we have reached out to current investors already involved in projects, those eager to invest, and other potential investors from the global arena. We are highlighting their success stories alongside similar achievements of Nepali investors. Additionally, we have extended invitations to numerous other investors and multilateral lending institutions from around the globe, either as sector experts or as key stakeholders in policy making. By bringing together these stakeholders, we expect to maximize the benefits of the summit this time.

Reflecting on past experiences, why does the government see the need for this summit now?

With a biennial schedule in mind, our intention was to host the investment summit in 2021, but the COVID-19 pandemic intervened. Similarly, in 2023, logistical constraints impeded our plans. This summit provides a crucial platform for stakeholders to voice concerns, facilitating systemic reforms to bolster investment climate and economic growth.

What prompts the timing of this investment summit this year?

We are bringing together prospective investors to gather their views on potential investment in Nepal. The summit also aims to disseminate a message that the government is ready to promote legitimate investment through reforms in government policies and managerial aspects. We do not maintain a disparity between foreign and domestic investors. We will endeavor to materialize some investments, while also showcasing projects to attract foreign investment. Platforms will be provided to discuss the modalities of new projects. We will present our good practices while also considering good practices from abroad. This time, we are organizing a multidimensional investment summit aimed at achieving multifaceted goals.

What outcomes does the government anticipate from this summit?

We are showcasing 140 projects, with most of them from the private sector. A few important projects originate from the government side. While some will involve new investment, some others will be discussed based on investors’ interest. Our preparations have been result-oriented. Although we have not set objectively defined targets, we consider the summit just the beginning. We will continue to advance the process in the future to attract as many investors as possible.

How does this investment summit distinguish itself from the past two summits?

This summit is not owned by a particular political party but is an event of Nepal as a state. We have provided space for experts from various sectors, including different political parties. Former finance ministers, regardless of their political affiliations, have been honored with key roles as panelists. The summit aims to enhance the competency of the economy to fulfill one of the components necessary to upgrade the economy from Least Developed Country (LDC) status by 2026. This will enable the country to access commercial loans at a time when grants and soft loans for the country will be significantly reduced. We aim to boost foreign investment through the summit to bridge the gap in capital injection that may occur despite an increase in domestic investment and government spending.

Addressing concerns about political instability, how does the government assure investors of continuity and policy consistency?

It is normal to experience changes in leadership at the political level, and the formation of a coalition government is common. The key factor is whether there is continuity in government policy or not. We have established a long-term vision for hydroelectricity production and maintained policy consistency in sectors such as cement manufacturing and the hotel industry. While policy revisions may occur, we always strive for a better investment-friendly environment and the generation of more employment. We are committed to maintaining the good practices formulated by previous governments, and the incumbent government is dedicated to achieving the overall development of the country.

In light of recent legislative amendments, how does the government reassure investors of ongoing regulatory improvements?

The government has already expedited the process of those laws considered essential for revision. This provides sufficient evidence to foreign investors that Nepal has demonstrated even greater concern for foreign investment. Additionally, the government has initiated a credit rating of the Nepali economy, which has not yet reached a conclusion. This will also ensure more transparency for foreign investors regarding the government's initiatives for an investment-friendly environment. This highlights the liberal policy of the country. We aim to ease investment-related policies, increase flexibility in investment volume, and reduce procedural hassles in the company registration process.

Concerns persist regarding profit repatriation; what steps are the government taking to address these apprehensions?

There is a separate law to address the repatriation issue. We plan to further ease the related laws to simplify the process. If we observe the financial position of multinational companies in Nepal currently, there are hardly any incidents where these companies face financial losses. Companies like Coca-Cola, Surya Nepal, Dabur, and Ncell, among others, are not incurring losses. If we examine the average rate of return of these companies, it is not significantly lower compared to other countries. Instead, we fail to bring forth the truth through proper measures, revealing the optimal level of success stories. Now, we will begin maintaining a proper database in line with this and move forward to inform the world.

Amidst evolving geopolitical dynamics, how does the government navigate these shifts to foster FDI?

Our approach is agnostic to geopolitical differences, prioritizing legitimate investments that enhance our competitiveness. By maintaining a fair and inclusive investment climate, we seek to attract diverse investors, irrespective of their political affiliation.

Hydropower has proven to be a lucrative sector for numerous investors. Nevertheless, some investors have raised concerns about underlying issues. With India's reluctance to purchase electricity from projects involving Chinese investment, there are apprehensions regarding compromised sovereignty, particularly when only one country is involved in these hydropower projects. How do you plan to address these concerns?

We have formulated and studied various types of plans for 10 years, 20 years, and 28 years. We have attempted to estimate how much energy, particularly clean energy, is needed in different time frames. Firstly, we require more of this energy for domestic use. Secondly, we have planned to sell surplus energy to India and Bangladesh, and to some extent, to China. We have progressed to install and strengthen infrastructure, including cross-border transmission lines in locations like Bhairahawa-Sunauli, Dhalkebar-Muzaffarpur, and Lamki-Barailey, facilitating energy trade. We will carry forward positive messages such as the agreement with India to sell 10,000 MW in the next 10 years and selling 40 MW of electricity to Bangladesh. Our energy supply is crucial for maintaining a sustainable energy balance in the South Asian market. The market is large enough to consume our production, which is why we are also considering producing solar energy and hydrogen-based energy in addition to hydroelectricity. Therefore, there is no problem; rather, the prospect is promising.

Post-summit, how will the Ministry of Finance coordinate with stakeholders to sustain investment momentum?

Collaboration with agencies like the Investment Board Nepal and the Ministry of Industry will be pivotal, with the Ministry of Finance spearheading policy coordination. By aligning revenue and investment policies, we aim to sustain momentum and foster a conducive environment for investment, leveraging inter-ministerial synergy and strategic decision-making.

Any final message for prospective investors?

Nepal offers a welcoming investment climate, underscored by ongoing policy reviews and a commitment to collaboration. Opportunities abound in sectors like hydropower, IT, agriculture, tourism, and mining, with potential for synergistic partnerships between domestic and foreign entities. Join us in realizing Nepal's economic potential, contributing to global competitiveness and sustainable development.

You May Like This

Political party leaders express commitment to ensure consensus to promote investment in the country

KATHMANDU, April 29: The third edition of the Nepal Investment Summit 2024 kicked off on Sunday with an aspiration of... Read More...

Govt spending increases under new FinMin

KATHMANDU, April 14: Since Barshaman Pun assumed the role of finance minister, government spending has increased significantly. The ministry has... Read More...

Doctors suggest Maoist Center leader Pun to undergo liver transplant

KATHMANDU, Jan 18: Doctors have suggested to deputy general secretary of the CPN (Maoist Center) Barshaman Pun to undergo a... Read More...

Just In

- Rato Machhindranath Jatra begins (With Photos)

- Bhatbhateni Supermarket Chairman Gurung pledges to contribute Rs 410 million to build a children's hospital

- Gold price surged Rs 2,500 per tola last week

- Sarlahi section of east-west electric railway project witnesses 90 percent progress

- 2.2 km road waiting blacktopping for over 22 months in Kaski

- NEPSE lost 33.73 points, while investors lost Rs 52 billion from shares trading last week

- KMC starts homework to draft policy and program and annual budget for FY 2024/25

- Joint meeting of Federal Parliament to be held on May 14, President to address the meeting

Leave A Comment